- Our Company

- Our business

- Investors

- Press-Room

- Sustainability

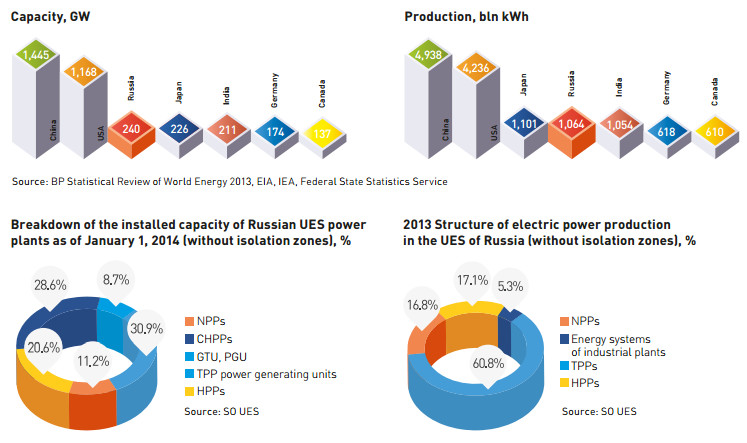

Among the world’s largest electricityproducing countries are the USA, China, Japan, Russia and India. Globally, in terms of installed capacity and production volume, the Russian energy industry ranks third and fourth, respectively.

As of January 1, 2014, the installed capacity of Russian UES power plants was 226,470.18 MW. In terms of installed capacity, the share of thermal power plants (TPPs) is approximately 68.2%, the share of hydro-power plants (HPPs) is 20.6% and the share of nuclear power plants (NPPs) is 11.2%.

The two principal types of activity conducted by grid organizations are: the transmission of electrical power over the electrical grids and the provision of technological connections for electricity consumers, the power plants of generating companies and the transmission facilities of other owners to the electric grid. These activities are both natural monopolies and are thus regulated by the State.

The operation and development of Russia’s electrical grid are the responsibility of JSC Russian Grids, a majority shareholder of Federal Grid Company, the operator of the Unified National (all-Russian) Electrical Grid (UNEG), JSC UES FGC, which operates the 110-1,150 kV high-voltage transmission networks, and Interregional Distribution Grid Companies (IDGCs) that control lower voltage distribution networks, from 0.4 to 220 kV. In addition, electric power transmission and distribution services are provided by more than 3,000 territorial network organizations (TNOs) that mainly operate the 0.4-10kV lines.

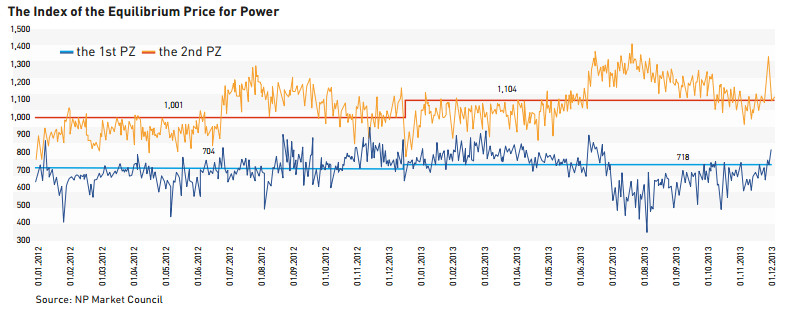

The day-ahead market (DAM) is a competitive selection of price bids from suppliers and buyers for the day before actual electric power delivery; prices and delivery volumes are defined for every hour of the day, and are conducted by the commercial operator, JSC ATS.

DAM prices have relatively high volatility due to, firstly, cyclical fluctuations (daily, weekly and annually), and secondly, due to price fluctuations caused by unpredictable demand- or supply-side changes.

According to the NP Market Council, the average weighted index of equilibrium prices for electric power during 2013 in the European part of Russia and the Urals rose 10.3% compared with 2012 and reached 1,103.9 RUR/MWh. In Siberia, the average weighted index of equilibrium prices during the past year rose 2.0 % - to 718.3 RUR/MWh.

The 2013 growth in electric power prices in the first price zone was mainly due to indexation, from July 1 and August 1, 2013, for gas prices, the main fuel for TPPs.

A reduction in prices in the second price zone in the second half of 2013 was caused by both a lower level of energy consumption and increased energy production at the Boguchanskaya HPP.

In 2013, the Russian government continued to make decisions to ensure a moderate increase in prices and tariffs on goods (services) for natural monopolies. In particular, electricity transmission tariffs and gas tariffs for industrial consumers are frozen for 2014, with previously proposed indexation starting from July 2014. In addition, 2015-2016 tariff growth forecasts were reduced.

Based on the approved 2014 socio-economic development forecast and the 2016-2016 planning period:

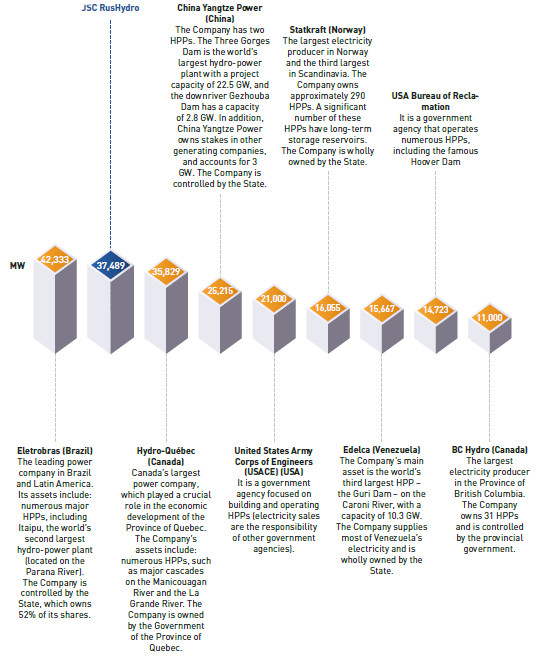

Installed capacity of the largest global peers

There are numerous power companies globally which rely on hydro-power plants for the majority of their capacity and which are also State-owned.

The Company’s Key Competitive Advantages

|

Hydro resources represent a renewable energy source that is the most environmentally friendly energy source, decreasing emissions from thermal and electricity power plants, while preserving hydro-carbon fuel reserves. |

|

HPPs offer the greatest degree of flexibility and can, if necessary, within minutes significantly increase energy generation to cover peak load. |

|

Not dependency on energy price volatility and, as a consequence, offers long-term price guarantees to consumers. |